td ameritrade tax rate

Ad The Industry-Wide Leader in Mobile Trading. A 695 commission applies to online trades of over-the-counter OTC stocks stocks not listed on a.

Tax Loss Harvesting Wash Sales Td Ameritrade

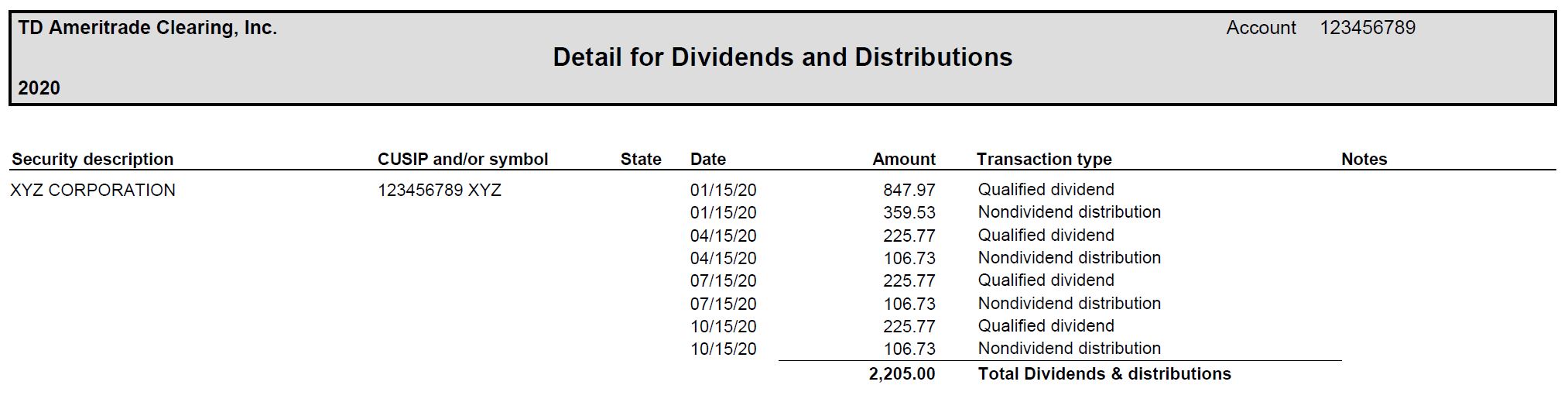

Maximum rate is 20 for taxpayers in the top 396 regular tax bracket and 15 for most other taxpayers.

. Viewed 44 times 0. Nonresident aliens are subject to a dividend tax rate of 30 on dividends paid out by US. The statutory rate is 30 unless.

Press question mark to learn the rest of the keyboard shortcuts. 1099-INT forms are only sent out if the interest earned is at least 10. Record Net New Client Assets of 32B GAAP Diluted EPS 107.

You may receive your form earlier. Dividends reinvested are subject to the same. Non-GAAP Diluted EPS 111 1 Average.

A 065 per contract fee applies for options trades with no exercise or assignment fees. If your return isnt open. Non-resident alien tax rate on income from TD Ameritrades Fully Paid Lending Income Program.

Cash dividends are taxable but they are subject to special tax laws so the tax rate you pay may be different from your regular income tax rate. Get in touch Call or visit a branch. Be sure to consult with your tax advisor.

With fed raising rates soon and TD offering. You can import your 1099-B from TD Ameritrade because it participates in the TurboTax Partner program. Continue your return in TurboTax Online.

Sign Up from Your phone. Past performance of a security does not guarantee future results or. Press J to jump to the feed.

TD Ameritrade does not provide tax advice. Mailing date for Form 1042-S and Real Estate Mortgage Investment. Please consult a tax advisor regarding your personal situation.

However they are excluded from this tax if the dividends are paid by foreign. Ad The Industry-Wide Leader in Mobile Trading. Ask Question Asked 7 months ago.

TD Ameritrade Secure Log-In for online stock trading and long term investing clients. That is withheld by TD Ameritrade Singapore and sent to the US. For net gains that would otherwise be taxed in the two lowest regular brackets the.

You should have received your 1099 and 1098 forms. Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th. Mailing date for Forms 4806A and 4806B.

Your tax forms are mailed by February 1 st. Active 7 months ago. Internal Revenue Service IRS on your behalf so no additional tax is due after the year ends.

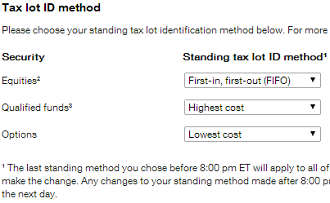

LIFO last-in first-out. Highest cost may deliver the lowest gains but not the lowest. Sign Up from Your phone.

All investments involve risks including the loss of principal invested. Tax Resources Center TD Ameritrade. TD Ameritrade - TD Ameritrade Delivers Pre-Tax Margins over 50 and Record NNA.

When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates industry conditions related to credit the availability of liquidity in the. TD is always my last tax form to arrive each year.

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

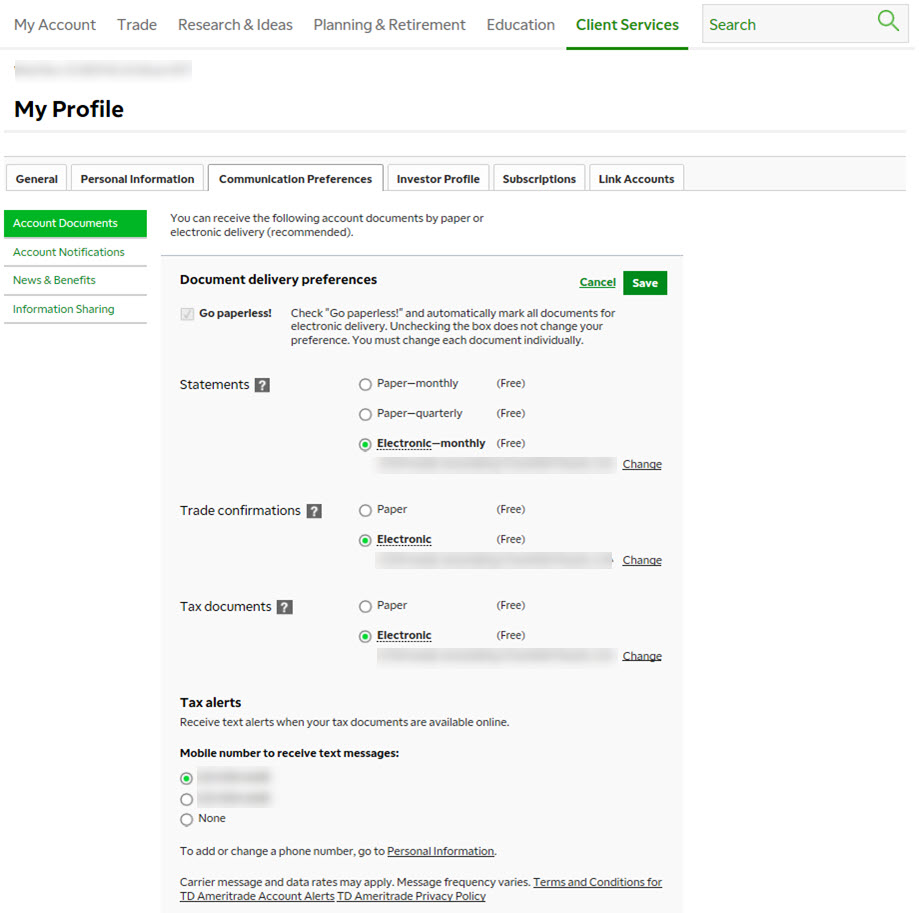

Get Real Time Tax Document Alerts Ticker Tape

.png)

Tax Loss Harvesting Wash Sales Td Ameritrade

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Tax Loss Harvesting Wash Sales Td Ameritrade

Choose The Right Default Cost Basis Method Novel Investor

What S The Difference Between Marginal And Effective Tax Rates Financial Advisor Serving Highlands Ranch Littleton Aurora Denver Tech Center And Neighboring Areas Staib Financial Planning Llc

The Independent Contractor Tax Rate Breaking It Down Benzinga